iowa inheritance tax form

Register for a Permit. Also Mutual Wills for Married persons or persons living together.

Adopted and Filed Rules.

. When this section applies proceedings for the collection of the tax when a personal representative is not appointed shall conform as nearly as possible to proceedings under this. All publicly distributed Iowa tax forms can be found on the Iowa Department of Revenues tax form index site. Up to 25 cash back Update.

In the meantime there is a phase-out period before the tax completely disappears. To pay inheritance and estate tax in the state of Iowa file a form IA 706. Use Get Form or simply click on the template preview to open it in the editor.

An inheritance tax is only imposed against the beneficiaries that receive property or money from the decedent. The personal representative is required to designate on the return who is to receive the clearance. Ad Fill Sign Email Form IT-R More Fillable Forms Register and Subscribe Now.

File your taxes stress-free online with TaxAct. Iowa Inheritance Tax Schedule A 60-002. If a federal estate tax return form 706 United States Estate Generation-Skipping Transfer Tax Return is filed a copy of that return must be filed with the inheritance tax return.

Form 709 must be filed to report the 3000 gift that exceeds the annual exclusion. This document is found on the website of the government of Iowa. Filing your taxes just became easier.

The Department will update tax forms and administrative. Report Fraud. An Iowa inheritance tax return is not required to be filed pursuant to section 45022 subsection 3.

1839019105 Reset Entire Form TOP OF PAGE 1839019105 NEXT PAGE PRINT FORM Pennsylvania Department of Revenue Instructions for REV-1839 application for Mortgage. Skip to main content. On Schedule E fill in the.

What is Iowa inheritance tax. And that individuals spouse. Wills for married singles widows or divorced persons with or without children.

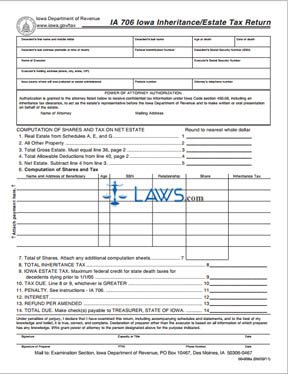

Iowa InheritanceEstate Tax Return IA 706 Step 1. _____Notary Public The correct. Quick steps to complete and eSign Iowa Inheritance Tax Form online.

Inheritance tax clearance will be issued by the Department. It may be necessary to file additional documents with the inheritance tax return if requested by the. Iowa Inheritance Tax Checklist httpstaxiowagov 60-007 072816.

_____ Subscribed and sworn to before me on _____ by _____. If a federal estate tax return is filed a copy of that return should be filed with your Iowa state inheritance tax return. Report Fraud.

See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611. Adopted and Filed Rules. This guidance describes those changes.

Iowa Inheritance Tax Schedule B. Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons. Anything that is payable to the estate upon death is not included in the.

Start completing the fillable fields and. Change or Cancel a Permit. Ad Download Or Email IA 706 More Fillable Forms Register and Subscribe Now.

If life insurance is shown on Schedule D include federal form 712 for each policy. If you wish to avoid an inheritance tax you can ensure that the net estate is valued at less than 25000. The Iowa State Department of Revenue may request additional.

These changes apply to tax years beginning on or after January 1 2022 tax year 2022. Track or File Rent Reimbursement. No gift tax is actually due assuming the gift was not over the lifetime exemption.

In 2021 Iowa decided to repeal its inheritance tax by the year 2025. Browse them all here. Alternatively or in addition you can ensure that the beneficiaries all fall.

If the return fails to. Ad Import tax data online in no time with our easy to use simple tax software. An Iowa inheritance tax return must be filed if estate assets pass to both an individual listed in Iowa Code section 4509.

Iowa Law Relating To Collateral Inheritance Tax A Complete Compilation Of The Iowa Statutes Relating To Collateral Inheritance Tax With Annotations From The Courts Of Iowa And New York

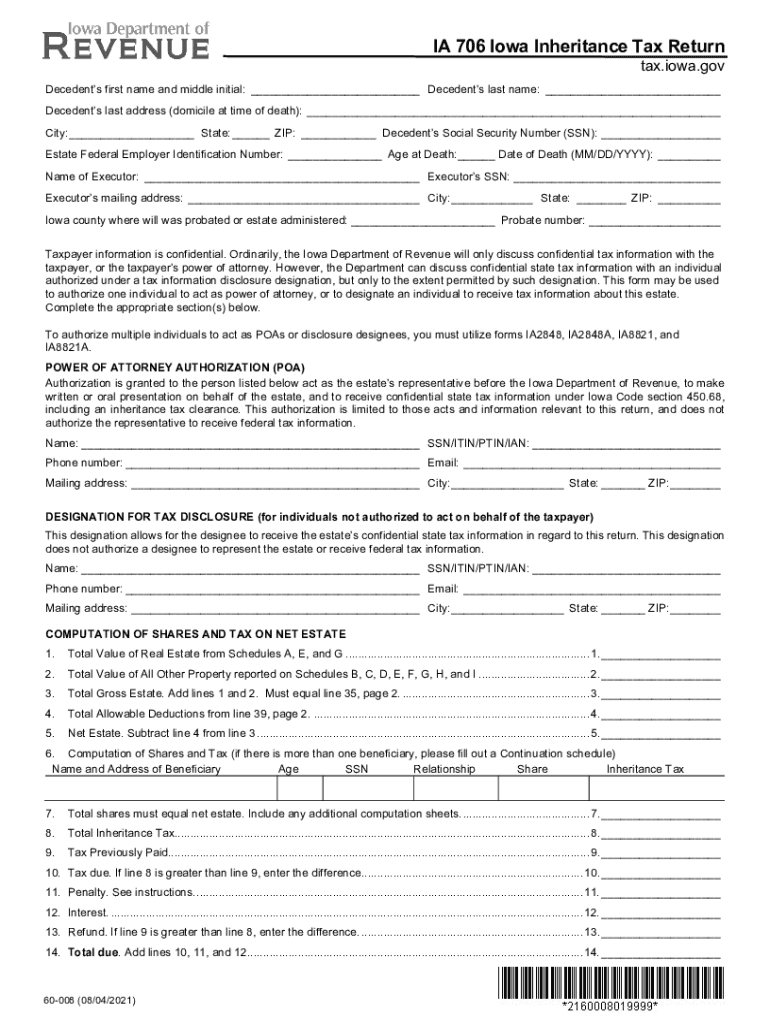

Free Form Ia 706 Iowa Inheritance Estate Tax Return Free Legal Forms Laws Com

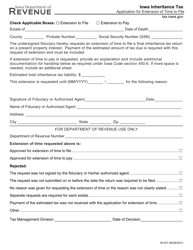

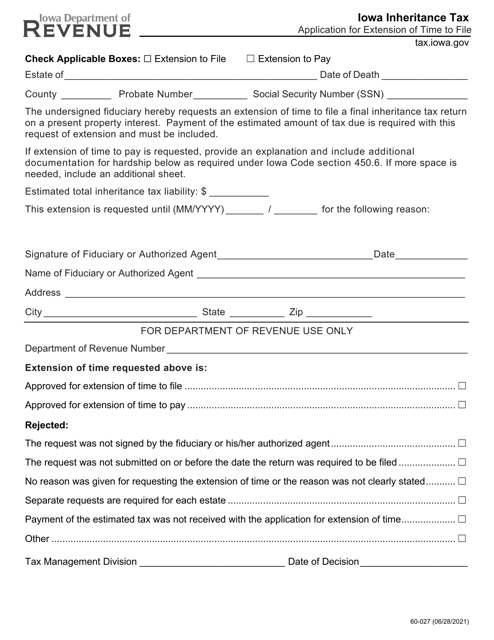

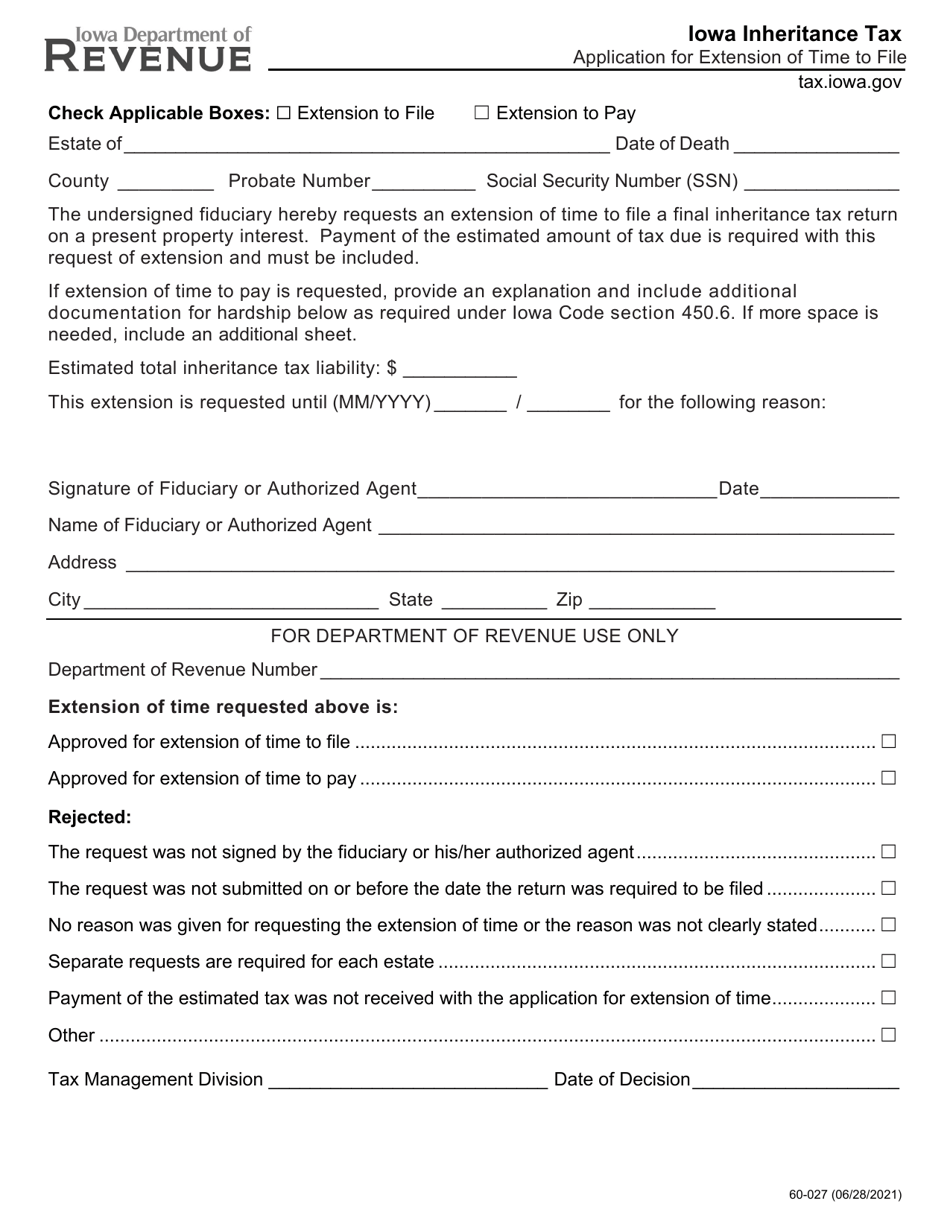

Form 60 027 Download Printable Pdf Or Fill Online Iowa Inheritance Tax Application For Extension Of Time To File Iowa Templateroller

Form 60 027 Download Printable Pdf Or Fill Online Iowa Inheritance Tax Application For Extension Of Time To File Iowa Templateroller

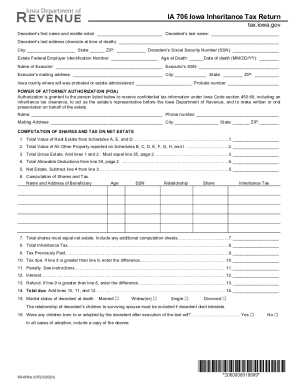

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

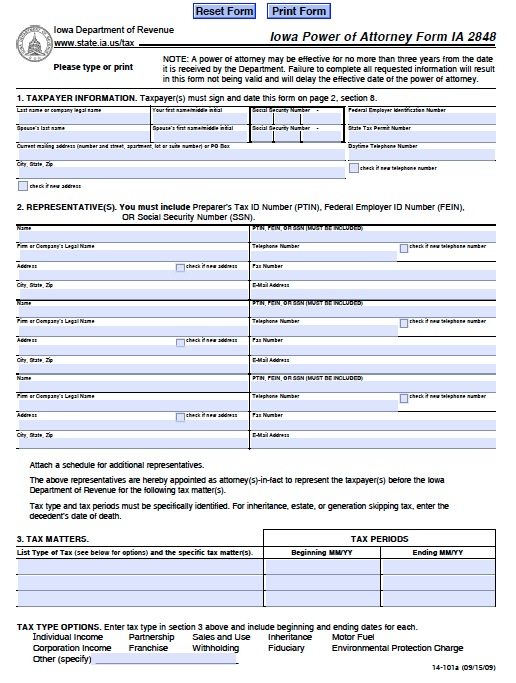

Free Tax Power Of Attorney Iowa Form Ia 2848 Adobe Pdf

The Estate Settlement Processag Decision Maker Iowa State Form

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

Form 60 027 Download Printable Pdf Or Fill Online Iowa Inheritance Tax Application For Extension Of Time To File Iowa Templateroller

Iowa 706 Schedule J Fill Online Printable Fillable Blank Pdffiller

Nebraska Inheritance Tax Worksheet Form Fill Out And Sign Printable Pdf Template Signnow